My Role & Task

At Allstate, I served as a Sr. User Experience Architect on the My Account team, where I contributed to several projects. One of my largest projects was Automated Endorsements.

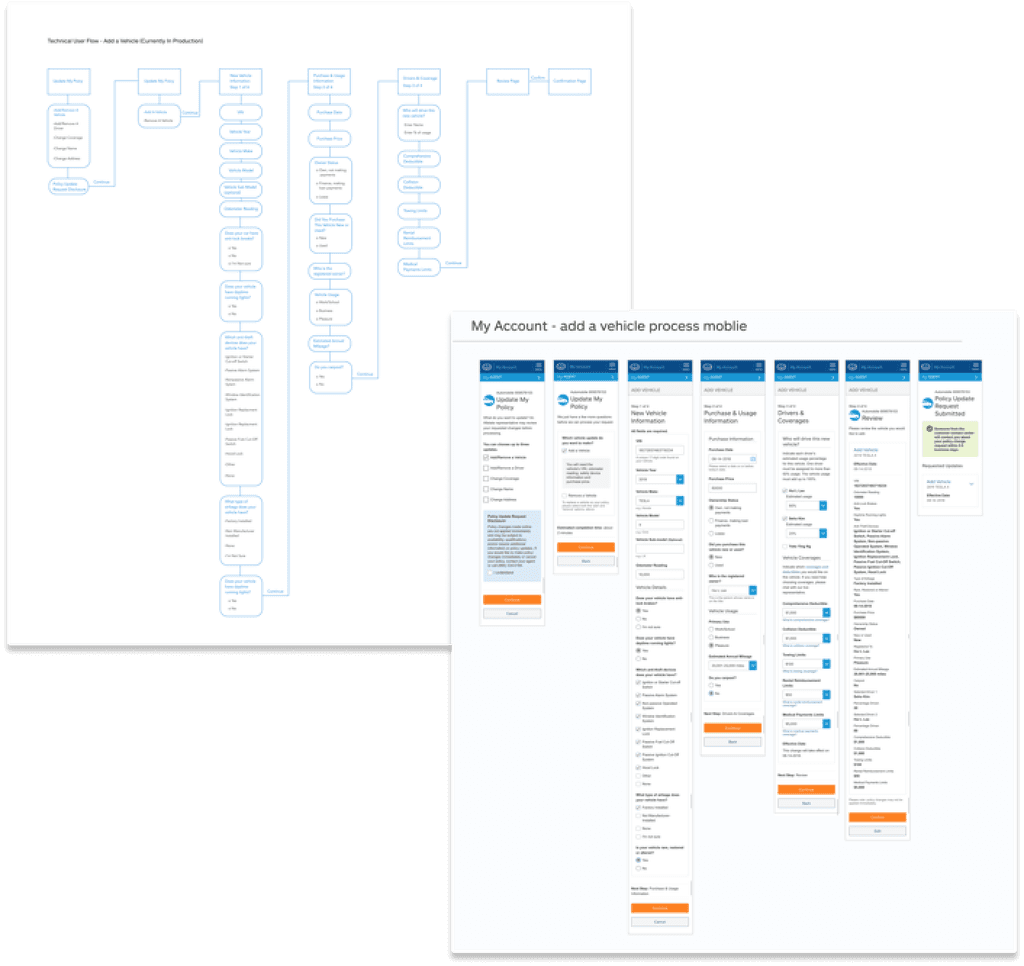

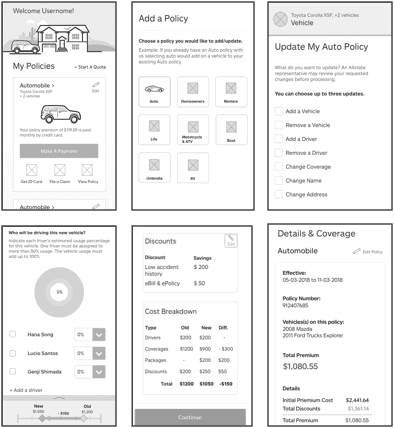

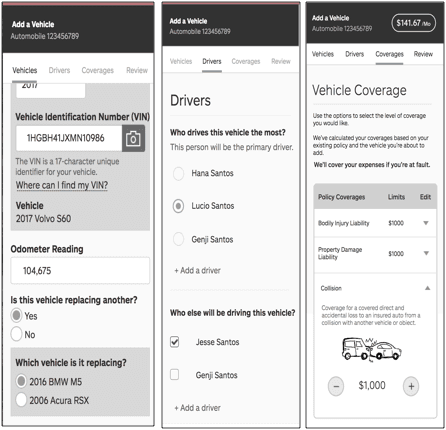

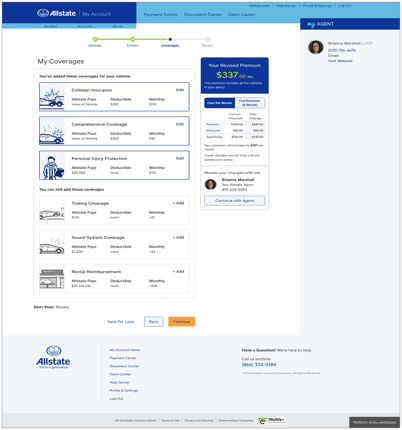

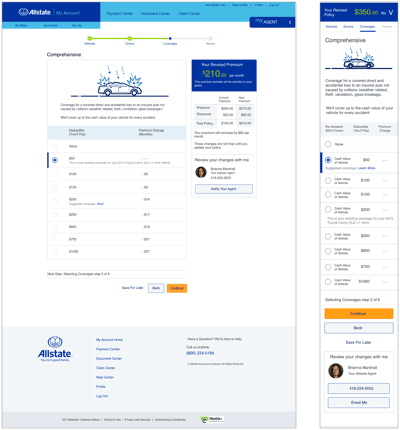

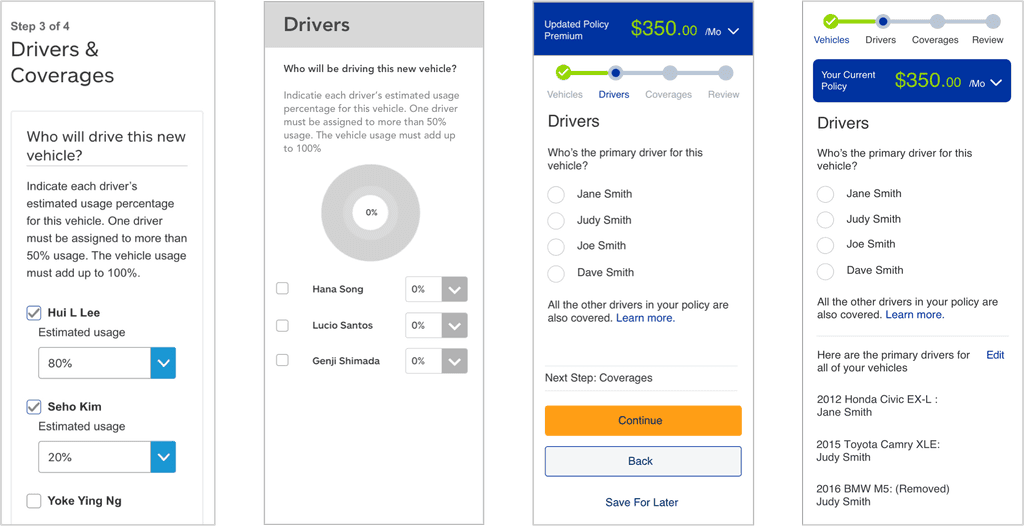

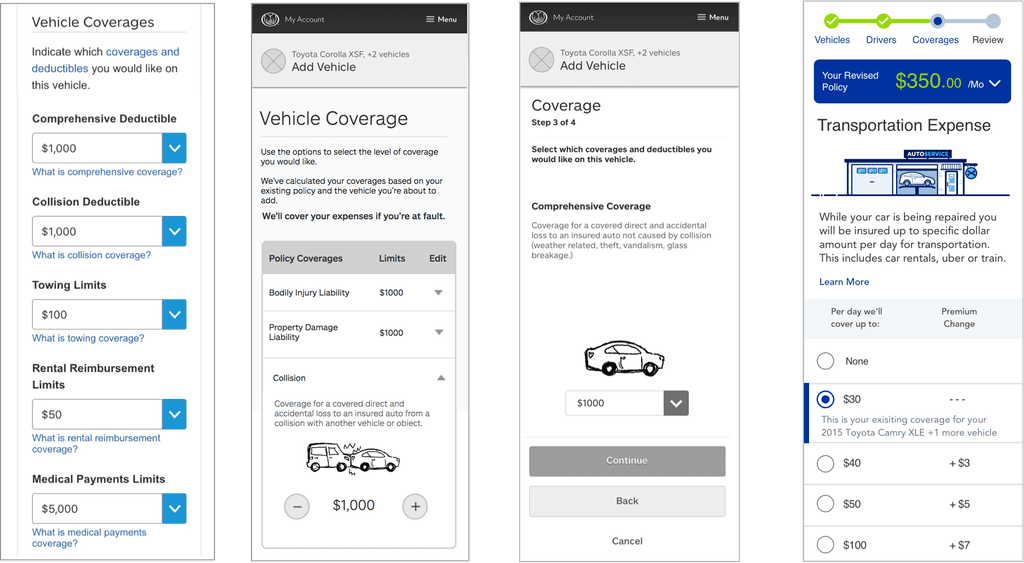

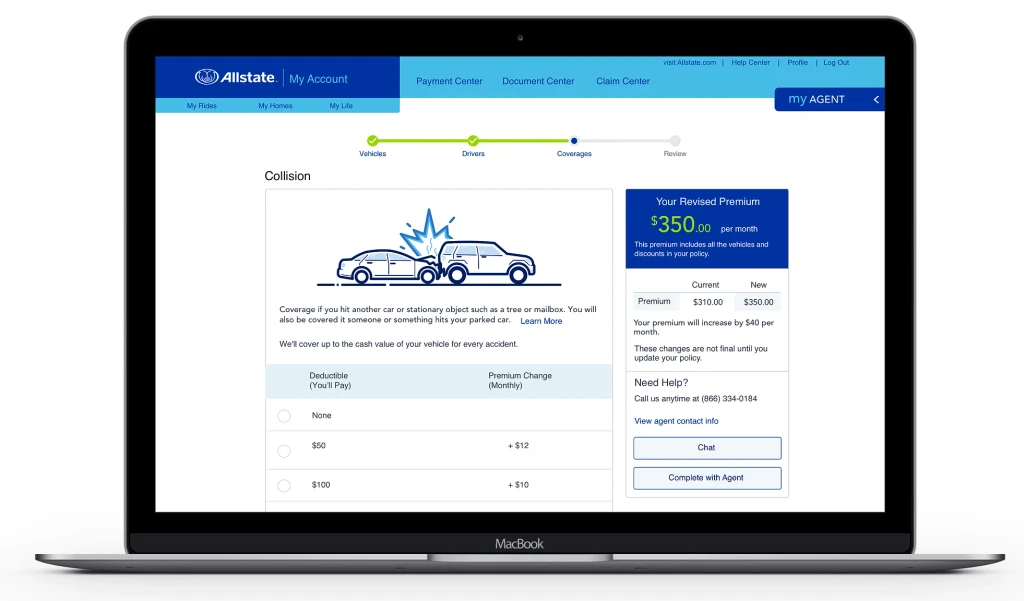

I collaborated with visual designers, copywriters, and researchers on a team tasked with creating a new process for customers to update their policies online. This process allowed customers to make changes, such as updating a lienholder, adjusting coverage, or adding a new vehicle, via desktop or mobile without needing an agent's assistance. Below, I will outline my processes, focusing specifically on the 'Add or Remove Vehicle' endorsement.

Goals 💯

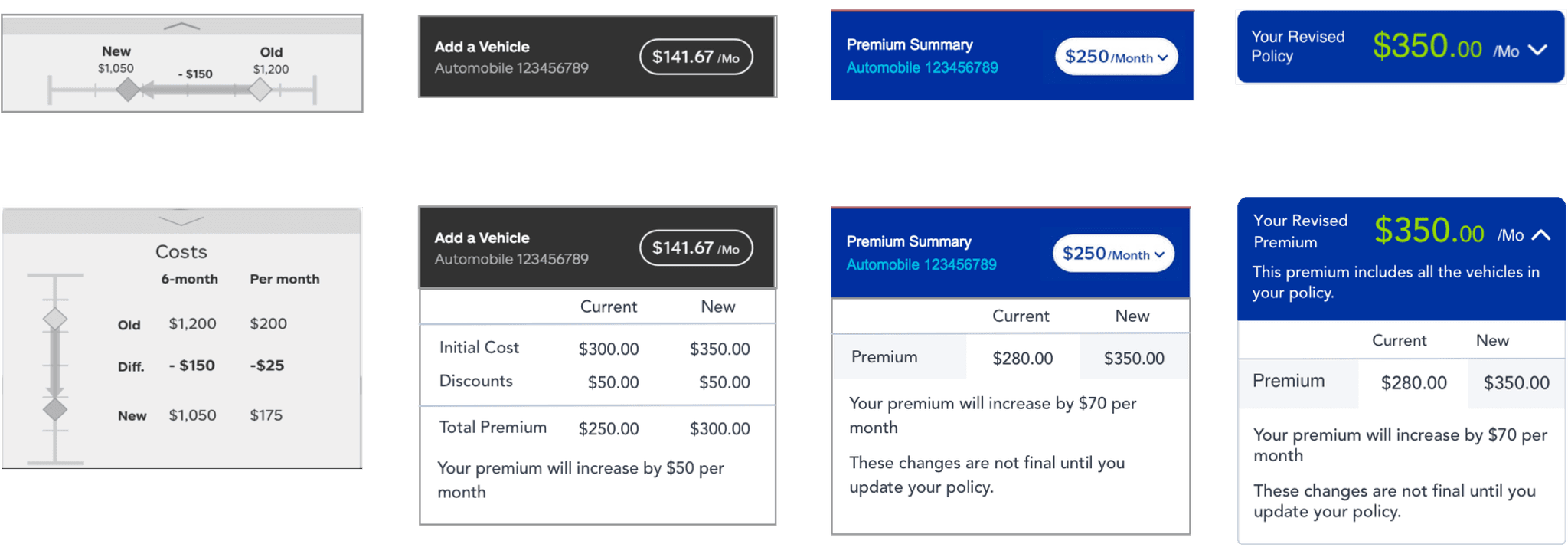

I wanted customers to make choices and be able to proceed with confidence.

I believe transparency is very important and the customer should know exactly what they are getting when spending their money.

At the same time, there needs to be a balance so customers won’t try to “game the system”.

I want customers to feel like this was easy and not a large burden to make any policy changes.

Challenges 🔥

Technology limitations (This meant I had to design around some of the legacy software used to make calls to receive customer information or a quote)

Other Allstate products were going through a rebrand. The product needed to be designed to still fit the old branding but could also transition into the new branding very easily.

The insurance industry has a negative stigma and can often be seen as sketchy and complex.

Key KPIs

Task completion rate

The percentage of users who successfully completed the process (e.g., adding or removing a vehicle) without needing agent assistance.

Pre-redesign: 40%

Post-redesign: 85%

Call deflection rate

The reduction in customer service calls related to policy changes.

Pre-redesign: 60% of users called agents for help

Post-redesign: 30% called agents

Repeated usage rates

Percentage of customers returning to use the online tool for additional changes.

Pre-redesign: 10%

Post-redesign: 40%

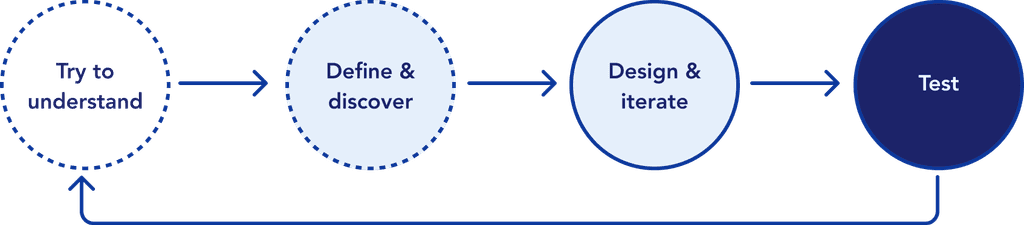

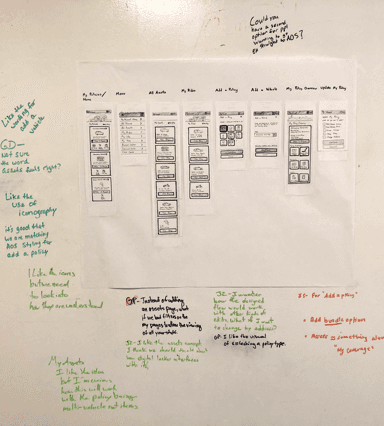

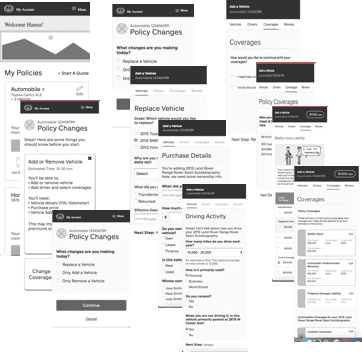

Discovery

I began with discovery work, mapping user flows and process charts for the existing system. Although online updates were available, the process was lengthy and ineffective. By partnering with the data analytics and business teams, we identified key pain points.

Low usage rates due to poorly defined entry points, making the feature hard to access.

High drop-off rates, especially during vehicle coverage selection.

Lack of clarity on how changes impact policy pricing.

A three-day processing delay with no real-time updates.